As we move through 2025, silver remains one of the most talked-about precious metals in the global market. Investors, jewelers, and collectors are all paying close attention to how 1 ounce of sterling silver performs amid changing economic conditions. sterling silver meaning

Although silver is more accessible than gold, its price continues to reflect growing industrial demand and long-term investment interest. This article explores what influences silver’s current value, the 2025 price outlook, and why it remains a reliable metal for both jewelry and investment.

Understanding Sterling Silver

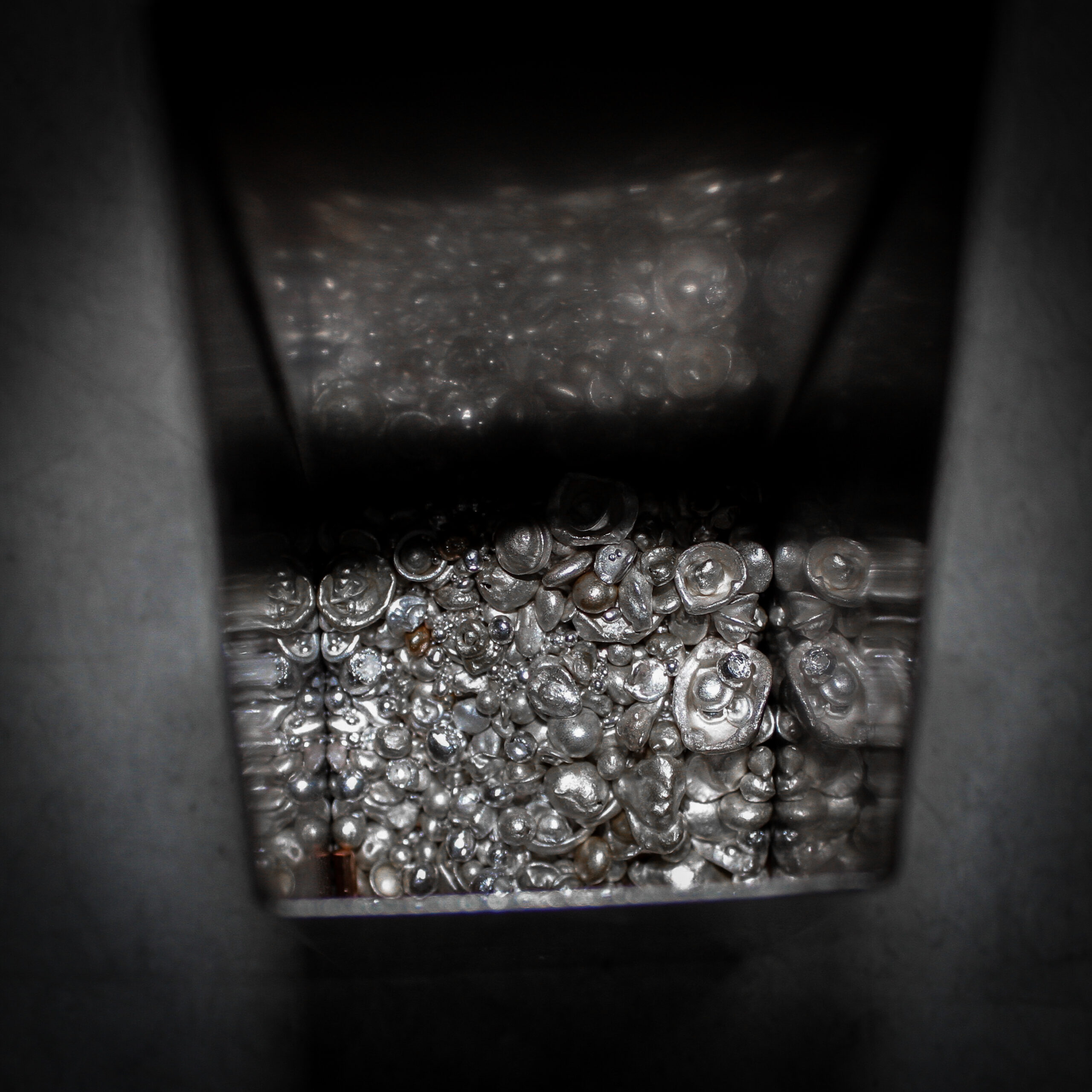

Sterling silver is an alloy made up of 92.5% pure silver and 7.5% copper or other metals. This blend ensures strength and durability while maintaining the metal’s bright luster. It’s widely used in jewelry, tableware, and fine accessories. Every authentic piece of sterling silver carries the “925” hallmark, which guarantees its purity.

Unlike pure silver (which is too soft for practical use), sterling silver can be molded into detailed designs without losing its form. Its aesthetic appeal, combined with affordability, makes it a top choice for jewelry manufacturers and consumers worldwide.

1 Ounce of Sterling Silver in Today’s Market

When we talk about 1 ounce of sterling silver, we’re referring to a troy ounce approximately 31.1 grams. The price of silver is determined by global spot markets, which fluctuate daily based on economic activity, mining output, and investor sentiment.

In early 2025, silver prices have shown consistent strength. As of mid-2025, the average spot price for pure silver ranges between $38 to $45 per ounce. Since sterling silver is 92.5% pure, 1 ounce of sterling silver would be worth approximately $35 to $41, depending on daily market variations.

While this number represents raw material value, the worth of silver jewelry or crafted items is typically higher because of design, labor, and brand markup.

Factors Affecting Silver’s 2025 Price Trends

Several factors are shaping the 2025 silver price outlook:

- Industrial Demand: Silver is essential in solar panels, batteries, and electronics. The global shift toward renewable energy has significantly increased its use.

- Economic Uncertainty: During inflation or currency instability, investors often turn to silver as a safe-haven asset.

- Mining Supply: Limited new mining projects and higher extraction costs contribute to upward price pressure.

- Global Investment Trends: Exchange-traded funds (ETFs) and private investors continue to increase their holdings in silver, boosting demand.

- Monetary Policy: Fluctuations in interest rates and the strength of the U.S. dollar influence global silver pricing.

These dynamics combined make silver one of the most reactive metals in global commodities trading.

Comparing Silver with Other Precious Metals

Although silver is less expensive than gold or platinum, it offers a unique balance between luxury and accessibility:

- Gold: Trades around $2,300–$2,500 per ounce in 2025, nearly 60 times more valuable than silver.

- Platinum: Averaging $1,000–$1,200 per ounce.

- Sterling Silver: Holds around $40 per ounce, offering affordability without losing its prestige.

This price range makes silver an appealing entry point for small investors and jewelers seeking a versatile material with consistent value.

Investment Outlook for 2025

Many analysts predict a bullish trend for silver in 2025 and beyond. The combination of renewable energy growth, industrial expansion, and limited supply may push silver’s spot price above $45 per ounce by late 2025.

Long-term investors consider silver a hedge against inflation and economic downturns. Even as markets fluctuate, silver’s role in both technology and jewelry ensures steady global demand.

Jewelry Industry Impact

In the jewelry world, 1 ounce of sterling silver remains a key material for crafting rings, necklaces, earrings, and bracelets. Designers love silver for its malleability and ability to complement both modern and traditional aesthetics.

However, as silver prices rise, manufacturers are adapting by using lighter-weight designs or mixing silver with gemstones to maintain affordability. Consumers still view sterling silver as a luxury option that offers beauty without the high price tag of gold.

Why Silver Remains Valuable

Beyond its monetary value, silver holds cultural, artistic, and emotional significance. It’s used in fine jewelry, heirloom collections, and ceremonial pieces. Unlike base metals, silver maintains intrinsic worth it can be recycled, refined, and reused indefinitely without losing quality.

In addition, the environmental sustainability of silver makes it a preferred material in modern manufacturing, aligning with global eco-conscious trends.

As of 2025, 1 ounce of sterling silver stands out as an affordable yet increasingly valuable asset. With prices hovering between $35 and $45, it remains a symbol of craftsmanship, investment security, and modern sustainability.

Whether you’re a jeweler seeking creative materials, an investor looking for diversification, or a collector who appreciates timeless beauty, sterling silver continues to prove that value isn’t just about rarity it’s about enduring appeal, purpose, and potential. In 2025 and beyond, silver shines brighter than ever as both an art form and a financial asset.